Non-Partisan Patent Data for HEVC SEPs

The pandemic has highlighted the value of high-quality video streaming, for both work and entertainment.

This makes it vital to understand the complex patent licensing landscape. LexisNexis® Cipher helps some of the world’s leading innovators, patentees, implementers and adopters improve their decision making and results by taking advantage of the best data analytics.

The first version of the High Efficiency Video Coding (HEVC) standard, also known as H.265, was approved in 2013. It succeeded the Advanced Video Coding (AVC, or H.264) standard, and offers significant improvements in resolution and efficiency.

While it took a while to be accepted, HEVC has now been adopted in many devices where users need to maximize the video quality while minimizing bandwidth usage, such as:

- Smartphones

- Tablets

- Televisions

- Games consoles

- Cameras

- Computers.

Video streaming (including high-resolution video) is essential for many applications today: the number of HEVC-enabled devices increased from less than 400 million in 2015 to over 1,750 million in 2020, according to Velos Media.

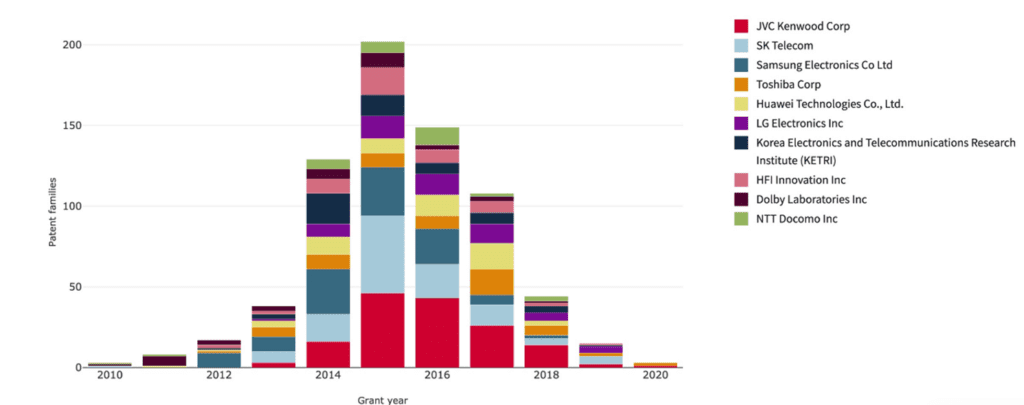

Fig. 1: Number of granted patent families at corresponding grant year by organization (Source: Cipher, 2021)

Current state of play with HEVC patents

But the patent position regarding HEVC is unusually complex. As in other standards-based technologies, patents declared to a standard are licensed on fair, reasonable and non-discriminatory (FRAND) terms.

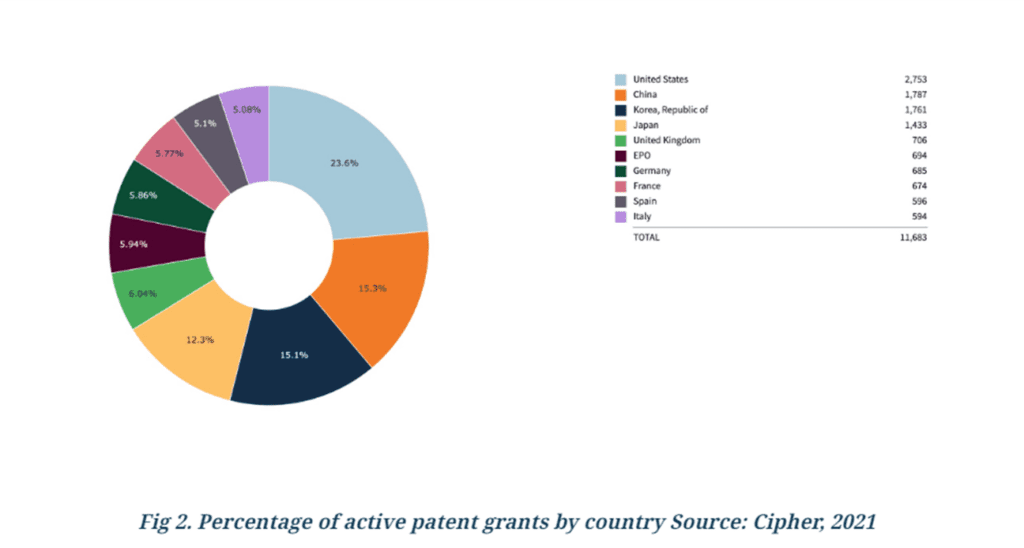

There are many thousands of patents declared essential to the standard, owned by many different entities (see figure 1, above) and registered in many different jurisdictions (see figures 2 and 3).

The importance of patent pools

Patent pools make it easier for implementers of the standard to obtain licenses by paying one royalty for access to SEPs from multiple patentees.

However, while earlier video standards typically had just one pool of essential patents which had to be licensed, for HEVC there are three pools:

- MPEG LA’s HEVC pool includes approximately 5,000 patents as of 3 May 2021 from about 50 licensors, including Apple, Canon, KETI, Samsung Electronics and Siemens.

- The pool run by Access Advance (formerly HEVC Advance) includes patents owned by companies such as Dolby Laboratories, Google, Huawei Technologies and Philips. This list includes nearly 14,000 patents as of March 19 2021.

- Velos Media does not publish full details of its patent pool, but states that it includes patents owned by BlackBerry, Ericsson, Panasonic, Qualcomm, Sharp and Sony.

To complicate matters further, some patent owners are part of more than one pool. Furthermore, there are some significant patent owners who are not members of any of these pools (including Nokia, Microsoft and TI)

The risks

This complicated position poses challenges for both licensors and licensees. Licensors need to identify which pool to join (if any) and monitor the enrolled patents – particularly if considering acquiring or selling portfolios.

They also need to ensure they obtain appropriate value for their patent rights, identifying which are essential to the standard and deciding how to license and enforce them where necessary.

Licensees meanwhile must identify which pools they need to join, or an alternative strategy to obtain the necessary rights, and ensure they allocate budget appropriately.

Not paying sufficient attention to this puts you at risk of infringing patents – and there are signs that SEP owners are asserting their rights more readily. For example, SEP owners such as Nokia and Ericsson have both brought actions against manufacturers of devices incorporating HEVC technology.

Nokia recently announced settlements with both Lenovo and Samsung: although the details are confidential, they reportedly include licenses to patents relating to video standards.

A second challenge for licensees is royalty stacking: the risk that the cumulative costs of licensing patents make implementation unprofitable.

Licensees need to be asking questions such as:

- What is the technology worth?

- Where is the value?

- How is it divided?

- What is a fair price?

But getting answers is hard, especially for SMEs who lack experience of licensing patents and in negotiating royalties.

For both licensors and licensees, the key to successful negotiation is having a comprehensive picture of the patent landscape, with analysis of where the value lies.

Using non-partisan patent data for HEVC SEPs

The successor standard to HEVC – Versatile Video Coding (VVC) or H.266 – was completed in July 2020 and patent pools are now being discussed.

VVC, which will enable more efficient 4K broadcast and streaming, is likely to be implemented in devices within the next few years. That means the time for patent owners to capture the value in HEVC patents is now.

The Cipher unique machine learning technology provides the best non-partisan patent data for HEVC SEPs to help both licensors and licensees establish where the value is in HEVC portfolios.

This enables IP executives to conduct successful negotiations and reach commercially sensible decisions.

How Cipher can help

Our analysis can provide data and charts to bolster your position and tip discussions in your favour, giving you a comprehensive picture of the landscape and promoting transparency.

Tailored reports enable you to obtain a realistic picture of your position, and ensure you are well equipped when entering licensing negotiations.

With this analysis, taken from non-partisan patent data for HEVC SEPs, you can discover where the value is in HEVC portfolios.